How I SOLD this challenging listing in 29 days!

Before we begin, I’d like to give a heartfelt Thank You to my Blog/LinkedIn readers. You have been extremely supportive over these past years, and I’m glad that I was able to help out many readers with your real estate transactions. This article is another example of how I was able to help a reader complete a very challenging transaction, while making a new friend in the process.

On March 10, 2019, I received the following message:

Hey Yinan, are you familiar with the East Gwillimbury market? I have a house listed right now, but not entirely happy with the service I’m getting. Can you take a look at the listing and let me know what you think? Just trying to get a rough feel for now, my agreement is up next weekend.

For those of you who aren’t familiar with East Gwillimbury, it sits on the Northern edge of GTA (Greater Toronto Area), quite far from the action (~45mins drive north of Toronto) and the area is experiencing a slow/buyer’s-market since the launch of the 15% foreign buyers tax and the B-20 stress testing.

The house itself is a brand new single garage detached home in Sharon Village, and it presents three (3) main challenges that makes it harder to sell:

- Challenge #1: it is brand new, never lived in, hence it is missing some of the essential appliances such as Air Conditioning

- Challenge #2: it doesn’t have a direct entrance to garage due to a last minute change in the builder’s plan

- Challenge #3: the worst problem of all, it has already been listed for sale by another real estate brokerage and it’s been sitting stale on the market for over 4 months! It did receive an offer near $730k but that’s way too far from seller’s expectation.

As you know, it is almost always easier to sell a property when it first hits the market, and the difficulty escalates quickly once it sits stale on the market for long, signaling potential buyers that perhaps this property isn’t desirable and/or there’s something wrong with it. The listing record remains in the property’s history forever even if a new real estate broker is used to sell the property, making the job of the latter realtor (myself in this case) much harder.

**Seller tip: treasure the first time that your property is listed for sale and fresh on the market as prospective buyers have less certainty on the popularity of this property, especially within the first 30 days. Sellers could capture higher price potential by exercising the right selling strategy during this period, and the property becomes exponentially harder to sell as time passes by.**

I decided to take on this listing despite its challenging situation as the seller is from within my LinkedIn network, and I’m determined to get it done right this time. Based on my analyses, there are 6 main areas of improvements that requires teamwork between the seller and my team:

- Since houses in these remote areas are more suitable for end-users than investors, we need to ensure it’s move-in ready for the buyer. Hence installing Air-conditioning is a necessary investment

- I personally visited a number of other houses for sale in the neighbourhood as part of the market research, and most of them do have direct access to garage from within the house. Luckily the positioning of the garage in the subject property still allows an entrance to be made by a qualified contractor

- Lighting is very dark throughout the house, making the house seem unpleasant and dull even though it’s brand new

- As it’s a smaller house, professional staging is necessary to bring out the best of the house and help buyers visualize the optimal use of the limited space

- No open house was done in the past 4 month for this property. Open-house is a direct and low-cost method to increase exposure of the property

- Aside from the locals who speaks English, German, and Italian, there are an increasing number of immigrants migrating to this region, such as Chinese and Korean. Wide-scale marketing outside of the traditional MLS is important to reach the full potential audience

Based on our list of findings and to-dos above, we executed the selling strategy with very quick turnaround time:

We installed Air-conditioning and created a direct-access door to the garage

We physically changed lighting throughout the house, and brought in beautiful staging sets, making the house feel bright, warm, and inviting.

Our team’s photographers and designers created beautiful and insightful marketing materials for the property, including its detailed upgrades, neighbourhood highlights, school zones, floor-plans, etc. in multiple languages, and spread them out on various online and offline social media/advertising platforms, reaching over 300k audiences

We also conducted open-houses every weekend to maximize exposure, with strategically placed signs for broader coverage (see map below). Prior to the open-houses, we drove-around the neighbourhood to knock on doors and distribute flyers to spread the awareness for this property for word-of-mouth referrals, generating additional traffic for the open-house.

On a very snowy weekend, we even rolled up our sleeves and shoveled the snow on the driveway as the owner lived far away and we didn’t want to affect/delay the open house schedule.

There are many other steps involved in the rest of this transaction as well as the negotiation process which I will have to save for another article, but at this point you probably get the gist: The devil is in the detail.

Long story short…the result?

As expected, we were able to quickly generate multiple interested parties of buyers, and I was able to make the two buyers compete for the property and SOLD the property at 99.6% of asking price in 29 days!

Seller was extremely happy about the turn out! They referred other family members to me and we kept in touch, conducting additional real estate transactions.

So, the secret of how I am able to consistently sell properties more successfully? Here it is:

~~~ drum rolls ~~~

Hard work, attention to detail, and more hard work.

As you can see, there are rarely shortcuts in life, certainly not in real estate. For each transaction, it’s ultimately a face-off between the two parties (buyer and seller) in terms of how informed, prepared, and knowledgeable they are regarding the property itself and the market. The “less ready” party will usually end up paying for the shortage of efforts they put into the transaction, giving the other party an upper hand in the negotiation process.

Real estate transactions are generally complex in nature, and each buyer/seller has a unique personal situation that needs to be factored into the equation. When you are choosing an agency to represent your interest in a real estate transaction, you are essentially choosing a project partner to work on a complex project side-by-side for a few weeks/months. Choose the partner that you trust who will dedicate their time to perform 120% of the work required, whether it is preparation/marketing for selling a property or research/due-diligence for purchasing a property. Also, ask your agent for past client testimonials to get a sense of his/her working style, which will help determine whether it matches your expectation for the service.

Questions? Feel free to contact me any time.

Yinan Xia, MBA, Broker

Yinan.realtor@gmail.com

Wechat ID: windysummer

How I helped save condo buyer client $6400+HST

A buyer client of mine purchased a 2 bedroom condo in 30 Nelson St in late 2018, a nice 2 years old building in a quiet neighbourhood extremely close to the financial district, making her daily commute a breeze.

I usually recommend my clients to hire a professional inspector for their protection unless they insist it’s absolutely unnecessary. In this case, the inspector found 2 issues that requires seller’s attention, hence I carefully worded them into the contract as follows:

“Seller agrees to submit a maintenance request to the building manager and obtain contractor quotes for

- fixing the visible cracks on the ceiling

- fixing the wobbly/uneven flooring near both bathrooms.

Seller agrees to either hire the contractor to fix the aforementioned issues prior to closing, or reduce the selling price by the same amount indicated on the contractor quotes. Buyer will be consulted to jointly make this decision.”

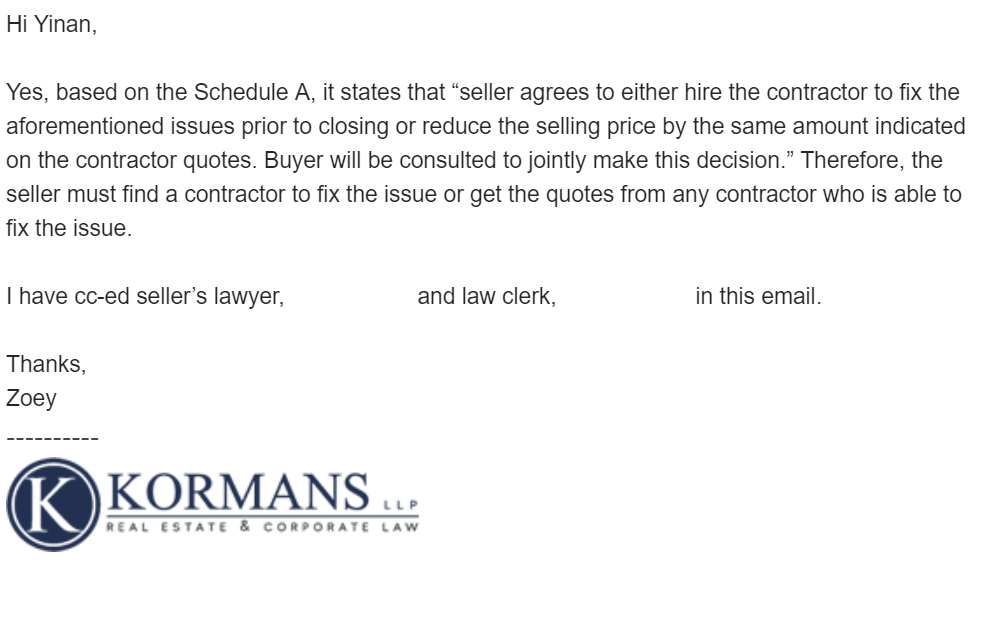

Upon the building contractor’s inspection, they have concluded that the wobbly flooring isn’t fixable, see below:

” He (the building contractor) also looked at the flooring by the bathrooms, and said that there is nothing that can be done about the flooring. There is a gap between the wood and the tile because of the concrete underneath and he will not touch the flooring.”

In many cases, it could have stopped right here since the building contractor has deemed the floor non-fixable as it’s basically a little part of the laminate flooring near the bathroom tiles that moves up and down a little as people steps onto it, and when all else fails, I believe the only possible solution is to replace the flooring for the ENTIRE UNIT, which could be a long shot from seller’s perspective.

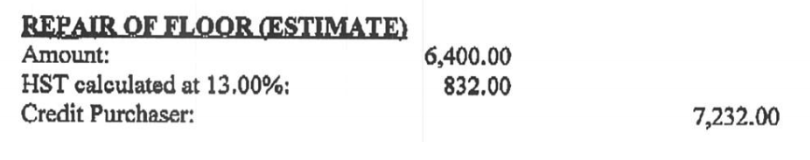

To protect my buyers, I reached out to our lawyer, and she was able to back me up since my wording in the contract was pretty tight and clear that seller must provide a solution and/or price reduction for whatever solution that’s feasible for addressing the issue, even if it means to replace the entire unit’s flooring:

With my lawyer on my side, I sent the following email to the seller:

“Regarding the flooring, per the contract seller is responsible for fixing the flooring or deduct price based on quote. Understand that the contractor prefer not to touch the floor because it is not an easy fix, but that doesn’t mean there isn’t an issue. What we ask is:

1) Have the contractor or alternative contractors make recommendations on what are the alternative possible options to fix the floor issue, associated with quote on cost

2) Provide a quote on replacing the entire unit’s flooring, if no other option is viable.

Understand that seller is going through a tough time right now and we don’t want to cause issues outside of the agreement. Just hoping that both sides do what we can to honour what’s been agreed upon so that buyer’s interest is also protected. “

As a result, the seller agreed to obtain a quote from a contract of their choice as follows:

“Labour and material to remove existing floor and install new floor matching existing one is $6400 plus HST”

That quote sounded little steep to me as I recently replaced my investment condo’s floor for much less, similar square footage, guess seller’s contractor based the quote on very high-end material/labor. Anyway, I’m responsible for maximizing the buyer’s benefit in this case, and given there’s limited time before closing, with our lawyer’s help, we were able to successful obtain the additional $6400+HST credit for my buyer, as shown on the closing adjustment:

And my buyer client gave me a big “HIGH FIVE”

Not to mention that the same unit layout, 5 floors below, were sold for 40K higher than my buyer’s net price only 2 months after!

Another “HIGH FIVE”!

Lesson of the day:

1) When it comes to your biggest purchase in life, hire a smart and experienced realtor who knows how to protect your interest and how to write customized contract clauses effectively. Even a great lawyer cannot defend a badly written contract.

2) Hire a good lawyer that’s not afraid of standing up for you, even when there’s the potential for litigation. Not all real estate lawyers have the same capabilities, choose wisely as it will make a difference when sh!t hits the fan.

Feel free to contact me if you have any questions.

Yinan Xia, MBA, Broker

Yinan.realtor@gmail.com

Wechat ID: windysummer

WHY are your Foreign-Buyer Tax refund claims getting rejected

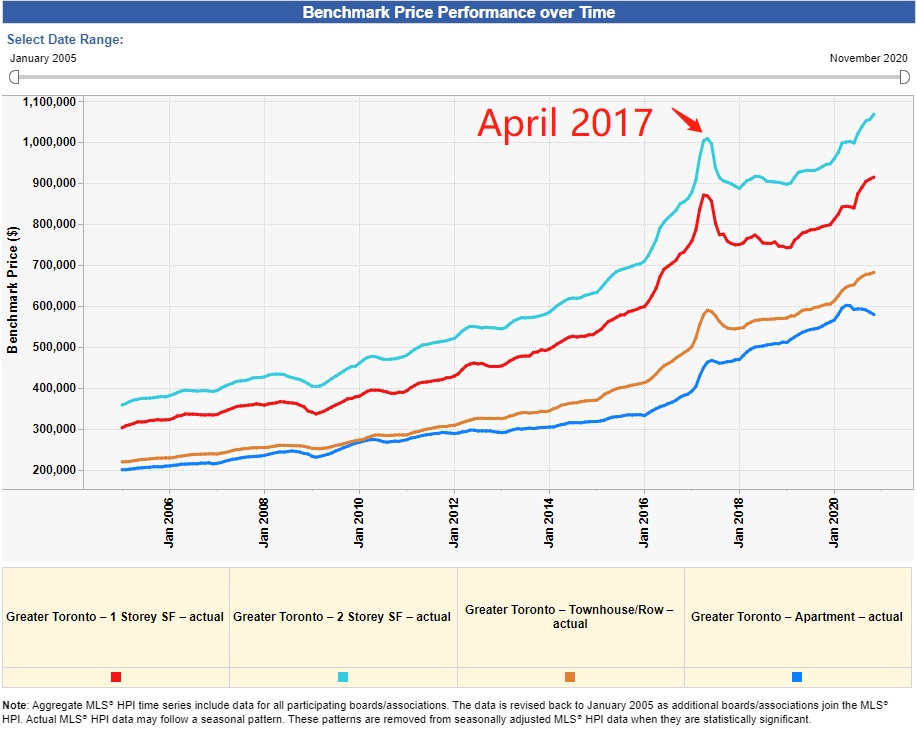

The NRST (Non-Resident Speculation Tax) took effect April 21, 2017. It’s a significant date in the real estate industry as housing price across GTA (Greater Toronto Area) and the rest of the Golden Horse Shoe Area (See map on right) plummeted almost right after the implementation of this tax.

(see price history chart below from one of my monthly analytics posts earlier)

This new 15% Tax comes with many rules, restriction, and exemptions, which I’m not going to bore you with in this article and they are readily available on the government site: https://www.fin.gov.on.ca/en/bulletins/nrst/#mapfaqs

As a realtor who has helped many foreign clients in the past years with properties involving paying this tax and getting it refunded, what I want to discuss today is what you need to look out for, practically, if you are planning to pay this tax with the hope of a refund later, as it may not be as easy as it claims to be (surprise…government doesn’t make it easy to refund hundreds of thousands of dollars…)

***Disclaimer*** I’m a realtor, not a tax specialist or lawyer, and I do not intend to provide tax or legal advice from this article. All the material written are based on my empirical studies from working with clients and/or speaking to other specialists, and your experience may vary depending on your specific situation.

Avoid making these mistakes in order to meet the NRST tax refund conditions:

1. The qualifying overseas buyer or spouse must hold 100% of the subject property. For example, a foreign student buys a property with foreign parents’ names on title in order to qualify for the mortgage, then even if the student does everything right to meet the qualification of refund, he will not receive the tax refund since he doesn’t own 100% of the property, even if parents only own 1% of the property.

2. Overseas buyers or spouses must personally move into the subject property within 60 days of purchase and use the property as their principle residence.

3. If overseas buyers get Permanent Resident (PR) status within 4 years after buying a house, they can apply. However don’t forget, once the applicant obtains PR (permanent resident) status, the applicable must apply for the tax refund within 90 days of receiving PR status.

4. International students continue to study full-time for two years after they have bought a property can apply for a refund, however, they must be in an Ontario campus and must be with a college or university approved by the government

5. Overseas buyers holding work permits must have a legal Ontario Work Permit when they buy a property (obtaining a work visa after taking possession of the property doesn’t qualify for refund). Must work full-time one year after buying the property. Full-time means at least 30 hours per week, and no less than 1560 hours a year.

Got any other tips and experience to share? Write them in the comments below. Feel free to contact me if you have any questions.

Yinan Xia, MBA, Broker

Yinan.realtor@gmail.com

Wechat ID: windysummer

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link