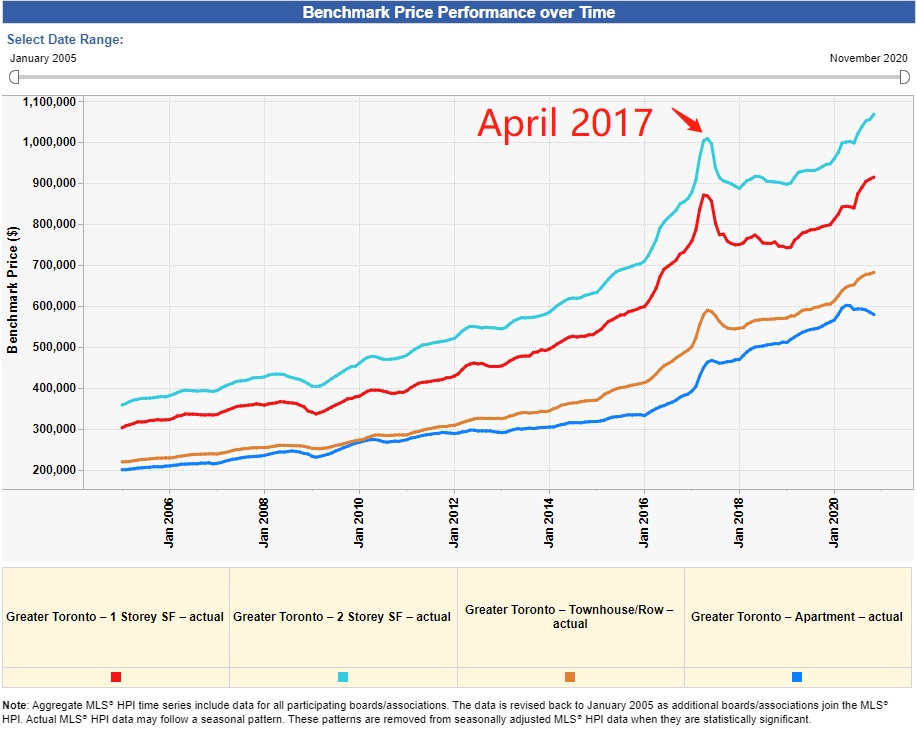

The NRST (Non-Resident Speculation Tax) took effect April 21, 2017. It’s a significant date in the real estate industry as housing price across GTA (Greater Toronto Area) and the rest of the Golden Horse Shoe Area (See map on right) plummeted almost right after the implementation of this tax.

(see price history chart below from one of my monthly analytics posts earlier)

This new 15% Tax comes with many rules, restriction, and exemptions, which I’m not going to bore you with in this article and they are readily available on the government site: https://www.fin.gov.on.ca/en/bulletins/nrst/#mapfaqs

As a realtor who has helped many foreign clients in the past years with properties involving paying this tax and getting it refunded, what I want to discuss today is what you need to look out for, practically, if you are planning to pay this tax with the hope of a refund later, as it may not be as easy as it claims to be (surprise…government doesn’t make it easy to refund hundreds of thousands of dollars…)

***Disclaimer*** I’m a realtor, not a tax specialist or lawyer, and I do not intend to provide tax or legal advice from this article. All the material written are based on my empirical studies from working with clients and/or speaking to other specialists, and your experience may vary depending on your specific situation.

Avoid making these mistakes in order to meet the NRST tax refund conditions:

1. The qualifying overseas buyer or spouse must hold 100% of the subject property. For example, a foreign student buys a property with foreign parents’ names on title in order to qualify for the mortgage, then even if the student does everything right to meet the qualification of refund, he will not receive the tax refund since he doesn’t own 100% of the property, even if parents only own 1% of the property.

2. Overseas buyers or spouses must personally move into the subject property within 60 days of purchase and use the property as their principle residence.

3. If overseas buyers get Permanent Resident (PR) status within 4 years after buying a house, they can apply. However don’t forget, once the applicant obtains PR (permanent resident) status, the applicable must apply for the tax refund within 90 days of receiving PR status.

4. International students continue to study full-time for two years after they have bought a property can apply for a refund, however, they must be in an Ontario campus and must be with a college or university approved by the government

5. Overseas buyers holding work permits must have a legal Ontario Work Permit when they buy a property (obtaining a work visa after taking possession of the property doesn’t qualify for refund). Must work full-time one year after buying the property. Full-time means at least 30 hours per week, and no less than 1560 hours a year.

Got any other tips and experience to share? Write them in the comments below. Feel free to contact me if you have any questions.

Yinan Xia, MBA, Broker

Yinan.realtor@gmail.com

Wechat ID: windysummer

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link